Mastering the multiscreen mix

Smarter buying strategies for agency decision-makers

Introduction: Media’s biggest investment challenge

When allocating budgets across screens, channels, and platforms, video stands apart. The high-impact format commands the largest share of spend, the highest CPM investments, and the biggest potential upside and downside risks.

Yet, media industry leaders know the current video supply chain is fundamentally broken. Whether you’re buying online video, connected TV (CTV), or digital out-of-home (DOOH), a complex maze of intermediaries dilutes campaign performance, increases the risk of fraudulent traffic, and often costs advertisers nearly half of every dollar spent.

Nowhere is this opacity more evident than resold inventory, where the average CTV ad might be offered through over 30 SSPs while mysterious middlemen extract fees as high as 39%.1

Leading brands and agencies are moving beyond this broken status quo with a new approach that prioritizes direct paths to premium video. This guide looks at how advertisers can scale performance across video investments with:

- Optimized supply paths that eliminate waste and opaque reporting

- High-impact ad viewability, engagement, and video completion rates

- Future-proof targeting using alternate ID and contextual signals

- Other financial and carbon supply chain efficiencies

The high-stakes uncertainty of video investment

Video investments have the biggest direct impact on bottom-line results, even as they are often made in an ecosystem that is highly complex.

- Video consumes 11-50% of digital media budgets for most marketers2, while nearly a quarter allocate 80% or more to the channel

- Video budgets are growing 20% annually3 . despite macro concerns, with CTV ad spend in the US likely surpassing $30 billion in 20254

- Scale and quality are the top 2 hurdles for over 70% of video ad buyers5

- Reselling is still widespread. Video investments have the biggest direct impact on bottom-line results, even as they are often made in an ecosystem that is highly complex, with 19.5% of the CTV bid stream comprising resold auctions.

Most Important Criteria When Buying Digital Video Ads According to US Agency/Marketing Professionals, March 2024

Source: eMarketer, based on Interactive Advertising Bureau (IAB), “2024 Digital Video Ad Spend & Strategy Report” in conjunction with Advertiser Perceptions and Guideline, April 25, 2024

US Digital Video Ad Spending, by Type, 2020–2024

Source: eMarketer, based on Interactive Advertising Bureau (IAB), “2024 Digital Video Ad Spend & Strategy Report” in conjunction with Advertiser Perceptions and Guideline, April 25, 2024

Fragmentation remains a persistent challenge

Video spend is splintered across social video, connected TV (CTV), online video, digital-out-of-home (DOOH), and other emerging formats. Multi-screen, omnichannel advertising strategies are critical to success, but they also come with new challenges.

The average digital video campaign now involves 4-6 different technology platforms, each extracting a toll on both efficiency and transparency.

Historically, these supply path intermediaries have cost advertisers up to 55 cents for every dollar spent.

In CTV environments, this “ad tech tax” from reselling results in publishers receiving 7-8% less revenue than they would through direct relationships , while advertisers pay inflated premiums without improvements in quality or performance.

Fragmentation also creates significant operational challenges:

- Multiple buying points across DSPs, SSPs, and publisher direct

- Inconsistent measurement across channels and platforms

- Varying levels of transparency in inventory quality and pricing

- Complex technical integrations requiring specialized knowledge

The new video supply path reality

As programmatic advertising undergoes a fundamental restructuring, brands and agencies must re-evaluate where and how they allocate video investments—finding the right balance of scale and quality.

The great convergence: SSPs and DSPs

While resold inventory once offered better connectivity, today it has become a significant industry burden, particularly in CTV. Hidden fees lead to substantial markups, every ad pod runs hundreds of calls in a bloated bid stream, and confusion lets fraudulent traffic thrive.

Weighed down by extreme complexity, the traditional programmatic supply chain—DSP to SSP to intermediary to media owner—is rapidly becoming obsolete.

Recent acquisitions are blurring the lines between buying and selling platforms, ushering in a new reality:

- Direct integrations are replacing daisy-chained connections

- Redundant ad tech layers and resellers are being eliminated

- Intermediaries are focusing more on direct access and capabilities

While resold inventory seems attractively priced, these savings come at the cost of quality, transparency, and outcomes. Many investment leaders feel increasingly uncomfortable if their team is not speaking directly to publishers, ad serving companies, and strategic SSPs.

The unique power of ad server control

As access to premium inventory becomes more competitive, the video ad server has re-emerged as the most strategic node in the video supply path. Partnerships with companies that control the ad server—rather than merely accessing it through intermediaries— provide significant strategic advantages in terms of inventory access and pricing transparency.

The ad server controls the transaction, determining key auction dynamics such as:

- Pricing and allocation of inventory

- Priority in competitive bid scenarios

- Access to unique signals and inventory

- Creative rendering and user experience

Direct paths: The new competitive advantage

For agency investment leaders, supply path optimization (SPO) has become a strategic imperative rather than merely a technical exercise. Simplified paths to inventory improve not only media efficiencies and brand safety but capabilities, performance, and ad outcomes.

Direct paths to premium video supply creates new advantages like:

- Pricing efficiency:

Eliminate intermediary fees and reduce bid duplication - Inventory priority:

Gain preferential access to high-value impressions - Data fidelity:

Preserve crucial context and audience signals - Future-proof targeting:

Activate at scale with IDs and contextual data - Carbon efficiency:

Reduce the computational overhead of multiple auctions

Implications for media investment strategy

The evolution of the video supply chain has profound implications for how investment leaders structure their buying strategies, from access and deal types to cross-channel measurement.

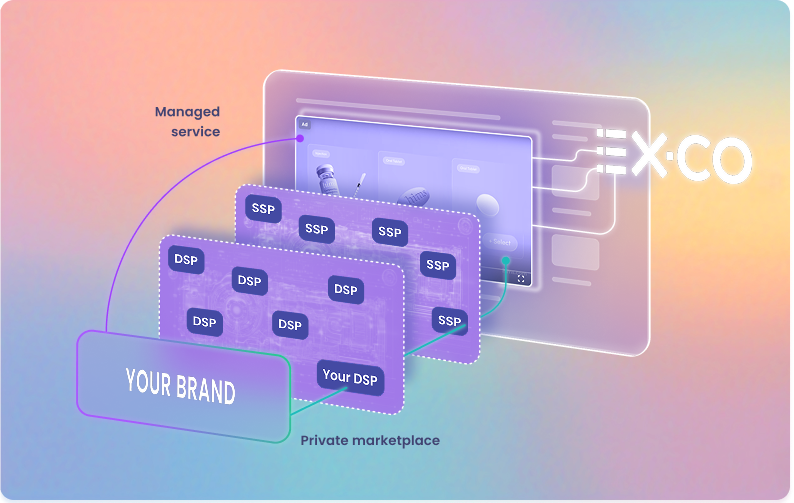

Optimizing deal types by media buy

For each video campaign, advertisers need to find the right balance of deal structures. While preferred or guaranteed deals come with premium pricing, it can be economically advantageous for high-value inventory where competition is fierce.

- Open exchange buying:

Lowest prices but least predictable, with limited priority - Private marketplace (PMP) deals:

Floor prices with increased probability of winning but no guarantees - Preferred deals:

First-look opportunities at fixed prices - Programmatic guaranteed:

Reserved inventory at negotiated prices

Navigating direct vs. intermediated access

Media buyers should avoid blanket rules when deciding between direct and intermediated access. A strategic framework can help balance efficiency with business priorities and maximize the impact of limited resources.

While direct relationships require more operational overhead, they are worth it for:

- Higher-value inventory quality and uniqueness

- Large, ongoing campaign investments

- Complex data targeting and integration needs

A strategic approach segments inventory into tiers based on value and approach:

Tier 1

10–20%

Strategic direct relationships with premium publishers, media groups, and video ad platforms

Tier 2

40-60%

Preferred or programmatic guaranteed deals through optimized paths

Tier 3

20-30%

Efficient open exchange buying with strong verification

Across tiers, investment leaders should prioritize transparency. Ask sellers if they have exclusive right-of-sale for every impression. For curated details, request a list of all sellers included in the Deal ID. These simple steps can uncover hidden reselling arrangements that inflate costs without adding value.

Bridging cross-channel measurement gaps

Fragmentation of video across screens creates challenges around measurement and attribution:

- Identity resolution:

Different channels use different identifiers (cookies, device IDs, household IDs) - Attribution windows:

Channels have different exposure-to-conversion timelines - Measurement granularity:

Metrics vary from individual-level to household-level

Many agencies are shifting back toward media mix modeling (MMM) and incrementality testing. Using these sophisticated methods, media buyers can see actual sales lift from a retailer, or combine cross-platform exposure and engagement data in real-time.

A holistic video measurement model increasingly combines multiple tiers of KPIs:

| Channel-specific | Viewability, completion rate, conversions, leads |

|---|---|

| Cross-channel | Audience match rates, frequency, overlap |

| Total ROI | Multi-touch attribution, sales, market share |

Future-proof your multi-screen video advertising

To stay ahead of changes in video, media investment leaders need to identify ad platforms that provide a sustainable competitive advantage in access, targeting, and creative formats.

Get closer to premium inventory partners

Premium video inventory is a finite resource, and access is only getting more competitive as consumption shifts to streaming environments. Video platforms with direct relationships to publishers and media groups can provide efficient access to a broad range of high-quality inventory across hundreds of top media properties.

To secure the inventory you need, seek out strategic partnerships rather than focusing on purely transactional buys:

- Long-term commitment models beyond individual campaigns

- Supply path partnerships that offer priority access through integrations

- Media consortiums that aggregate premium inventory at scale

Tap into privacy-safe video advertising

As third-party cookies and device IDs face increasing restrictions, advertisers are shifting toward solutions that prioritize privacy and performance.

The most effective video platforms ensure:

- Privacy-compliant audience targeting without reliance on cookies

- Secure environments that support integrations with privacy-safe data partners

- Contextual targeting based on content rather than user identity

Explore creative formats beyond pre-roll

Advanced creative formats for video drive higher ad engagement. But these often require direct partnerships with video platforms, as standard intermediaries lack the technical capabilities to support them. Agencies should evaluate partners on:

- Dynamic creative optimization that tailors messaging based on contextual factors

- Contextual recommendations that multiply user engagement

- Vertical video players that dramatically improves user experience

- Shoppable video that shortens the path to conversion

- Interactive elements that drive user participation

EX.CO’s complete video solution: quality, efficiency, scale

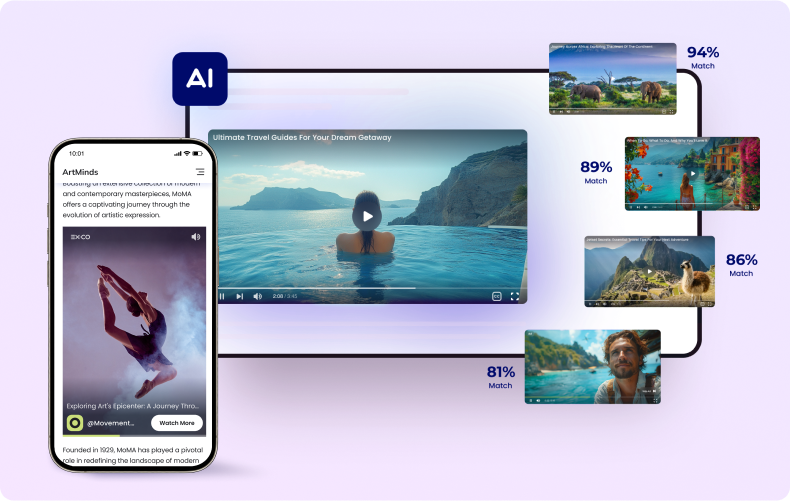

EX.CO offers the most efficient access point to clean video at scale, while delivering powerful machine learning video technology for every screen.

Publisher-direct platform with proprietary ad server control

As a publisher-first video platform, EX.CO maintains direct relationships with the world’s leading media owners, with over 14 billion annual ad impressions—and growing. EX.CO’s proprietary, machine-learning-based ad server technology provides several distinct advantages:

- Premium placements:

Pair your pre-roll with contextually relevant video content across the best video environments in OLV, CTV, and DOOH. - Unique inventory signals:

Get the right message to the right audience at the right time with first-party access to contextual and environmental data. - Flexible ad serving priority:

Gain more control on content, bids, targeting, and filtering on inventory you’re already buying. - Supply path efficiency:

Eliminate intermediaries with a trusted partner that offers zero take rates, no tech fees, and a carbon-efficient supply path certified by Scope3.

This platform approach enables investment leaders to implement sophisticated video strategies at scale across multiple publishers and streaming media groups, rather than negotiating individual publisher relationships.

Conclusion: Take control of your video supply path

Securing priority access to premium video inventory will only get more competitive in the years ahead. Now is the time for media and advertising leaders to take control of their video strategy. By developing a strategic, simplified approach to supply path optimization, investment leaders can:

- Improve working media efficiency and eliminate fees

- Maintain priority access to premium inventory

- Avoid the “too good to be true” risks of resold inventory

- Enable advanced creative and data capabilities

- Deliver superior client outcomes and competitive advantage

Investment leaders who develop a sophisticated supply path strategy today will be best positioned to succeed in the increasingly complex video landscape of tomorrow.

Sources

- “The Real Cost of Resold CTV”, Jounce Media, April 2025

- Wyzowl, “Video Marketing Statistics 2025”

- EMARKETER, “5 Charts on Video Ads”

- EMARKETER, “Combined CTV and Linear TV Forecast”

- EMARKETER, “5 Charts”

Ready to optimize your video supply path?

Speak with one of our experts to learn how the EX.CO platform can enhance your video investment strategy.